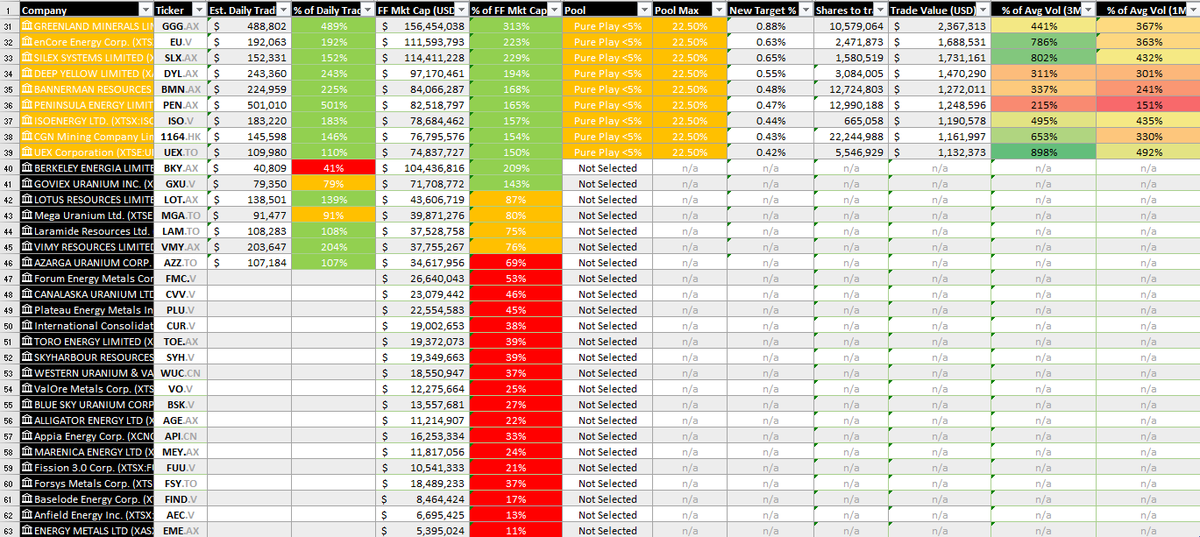

1/ Just 2 trading days left before the Global X $URA #Uranium ETF rebalancing. Based on my interpretation of the rules and rough calculations, here's my take on who will added to the ETF; $GGG.AX, $EU.V, $SLX.AX, $DYL.AX, $BMN.AX, $PEN.AX, $ISO.V, $1164.HK (CGN), and $UEX.TO.

2/ $BKY.AX and $GXU.V fulfills the FF Mkt Cap criteria but fall short of the avg daily trading value criteria. I don't have the daily trading value data, so my calc is based on the avg of the daily open and close prices multiplied by the volume. There's some room for error there.

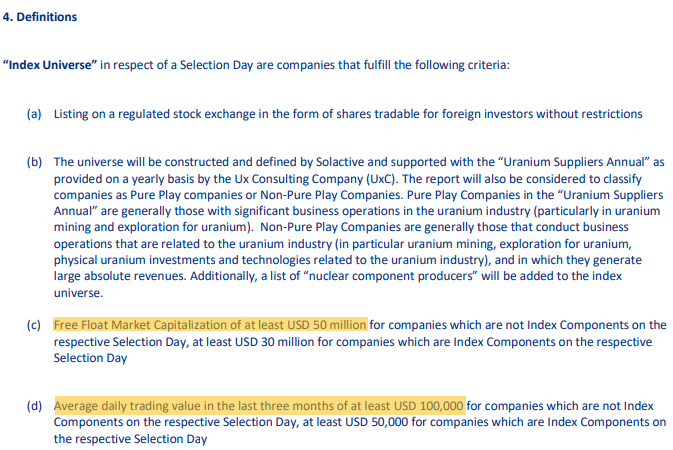

3/ There are 2 main selection criteria for new additions to the ETF; a U$50M Free Float Mkt Cap and a daily avg trading value of min U$100,000 in the last 3 months (leading up to January 15th).

Here are the full selection guidelines:

https://www.solactive.com/wp-content/uploads/2020/08/Solactive-Global-Uranium-Nuclear-Technology-Total-Return-Index_2020_08_13.pdf

Here are the full selection guidelines:

https://www.solactive.com/wp-content/uploads/2020/08/Solactive-Global-Uranium-Nuclear-Technology-Total-Return-Index_2020_08_13.pdf

4/ The underlying index has already provided a list of companies that are eligible for selection. Only these companies will be considered as part of the selection process, which is purely rules-based. https://www.solactive.com/update-market-watch-solactive-global-uranium-nuclear-components-total-return-index-december-2020/

5/ Selection Day is Friday, January 15th. Adjustment Day is Friday, January 29th. The majority of shares will be purchased in this window.

6/ Initial price reaction will likely be bigger in the names with lower daily vol. The last two columns in the calc is expected $URA shares to buy divided by the 3M and 1M avg daily volumes. As volumes have spiked lately, the effect will probably be lower than prev rebalancings.

7/ Although the forced buying by $URA might not move the dial alone, it could add fuel to the fire if the market decides to pile in on any policy news from the Biden administration in the coming days.

8/ Another interesting (possible) addition is Silex Systems. Silex and Cameco have an agreement to buy GE-Hitachi Global Laser Enrichment LLC. $SLX.AX $CCO $CCJ

https://world-nuclear-news.org/Articles/DOE-amends-agreement-for-UF6-sale,-outlines-dispos

https://world-nuclear-news.org/Articles/DOE-amends-agreement-for-UF6-sale,-outlines-dispos

9/ The deal needs to be approved by several departments of govt as the two buyers are foreign entities. They got the nod from the DOE last week. It could be a double boost in a matter of weeks for $SLX.AX.

http://www.silex.com.au/getattachment/9846955c-f861-4396-8845-4ef31d74bd7e/17-SLX-GLE-Restructure_NRC-Matters-2021-01-08.pdf.aspx?ext=.pdf

http://www.silex.com.au/getattachment/9846955c-f861-4396-8845-4ef31d74bd7e/17-SLX-GLE-Restructure_NRC-Matters-2021-01-08.pdf.aspx?ext=.pdf

10/ Silex CEO Michael Goldsworthy said: “The granting of the GLE Facility Clearance is the key step in gaining full US Government approvals for the transaction.”

“We anticipate the remainder of this process to be concluded in the coming weeks."

“We anticipate the remainder of this process to be concluded in the coming weeks."

11/ I would appreciate feedback if anyone has come to other conclusions. It'll be interesting to follow the price action in the sector for the next few weeks with lots of US nuclear policy headlines coming out.

Read on Twitter

Read on Twitter