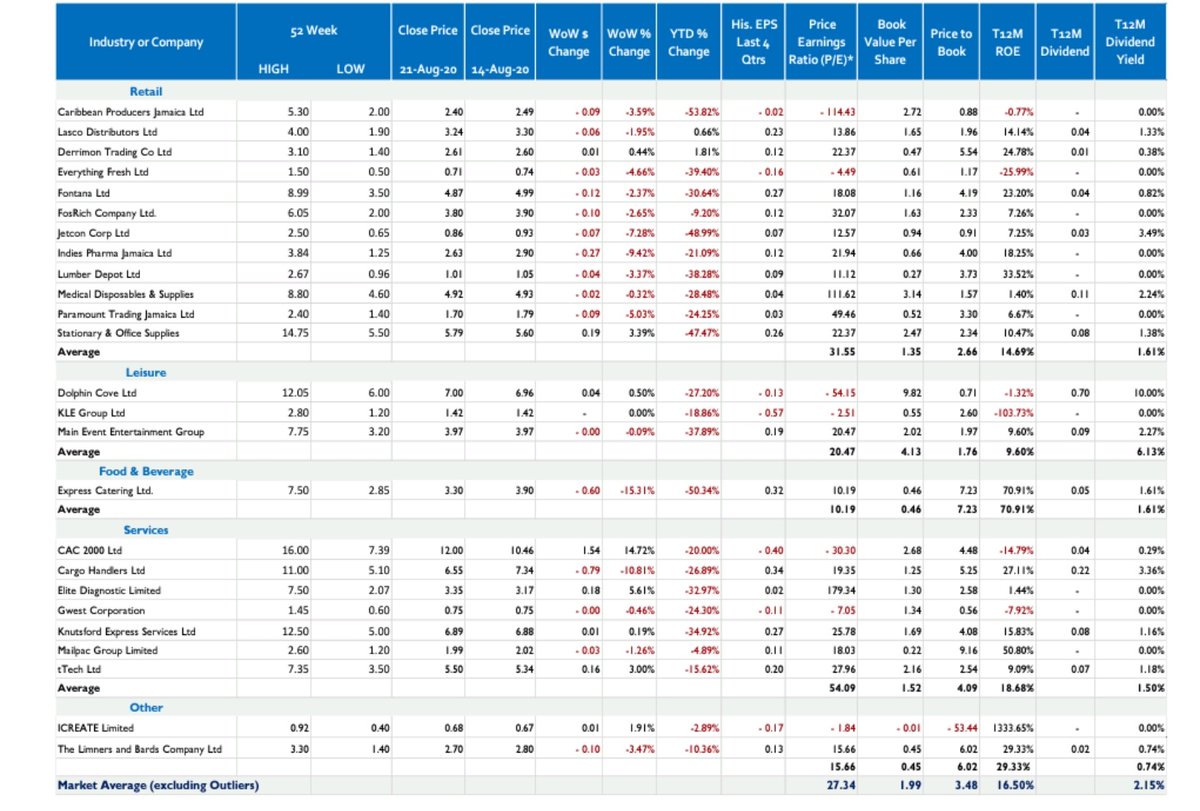

Taking a stroll through some market fundamentals today.

**data from JN. I assumed that their maths works out.

PE- Price to Earnings

PB- Price to Book

ROE- Return on Equity

Typical glance at fundamentals and then jump into financials of the attractive ones for context.

**data from JN. I assumed that their maths works out.

PE- Price to Earnings

PB- Price to Book

ROE- Return on Equity

Typical glance at fundamentals and then jump into financials of the attractive ones for context.

Main market financials.

$EPLY.JA has a nice above avg ROE but a premium PE.

$SCIJMD.ja decent PE, very low PB, and a shabby ROE

$JMMBGL.ja $PIL.ja and $SIL.ja trading at single digit PEs with double digit ROEs

$SGJ.ja double digit dividend yield

$JSE.ja PE almost 30x

$EPLY.JA has a nice above avg ROE but a premium PE.

$SCIJMD.ja decent PE, very low PB, and a shabby ROE

$JMMBGL.ja $PIL.ja and $SIL.ja trading at single digit PEs with double digit ROEs

$SGJ.ja double digit dividend yield

$JSE.ja PE almost 30x

MM Manuf.

Construction Chicken Food and Wata.

All trading within a similar PE range (21-27x) but only $WISYNCO.ja had a double digit ROE. $SALF.ja not included because that 48x PE is way out.

Consumer staples anytime for me.

Only $SEP.ja is up in price YTD.

Construction Chicken Food and Wata.

All trading within a similar PE range (21-27x) but only $WISYNCO.ja had a double digit ROE. $SALF.ja not included because that 48x PE is way out.

Consumer staples anytime for me.

Only $SEP.ja is up in price YTD.

Can seh boom and assume that falloff in price accounts for market adjustment to the effects of the COVID induced measures.

If the prices dropped more than is reasonable to adjust the valuation then that's attractive and vice versa.

Use financials and news for context.

If the prices dropped more than is reasonable to adjust the valuation then that's attractive and vice versa.

Use financials and news for context.

$KEY.ja is up 150%+ YTD, PB at 0.5. Guess post M&A speculation drove that.

$RJR.ja sigh. No comment. Maybe the election money and advertising gives them a boost?

advertising gives them a boost?

$GK.ja still looking like theirs some steam left. ROE in double digits is good, usually see at around 9.

$RJR.ja sigh. No comment. Maybe the election money and

advertising gives them a boost?

advertising gives them a boost?$GK.ja still looking like theirs some steam left. ROE in double digits is good, usually see at around 9.

PB for $GK.ja below 1x. Conglomerate discount?

$SVL.ja traded down 45% YTD. 42% ROE and 6% div yield. Expectations? Haven't looked at them.

I look at PB for some real estate. Most are getting hit. $SML.ja trading at 0.09? Dividend yield good but that BPO

Dividend yield good but that BPO

$SVL.ja traded down 45% YTD. 42% ROE and 6% div yield. Expectations? Haven't looked at them.

I look at PB for some real estate. Most are getting hit. $SML.ja trading at 0.09?

Dividend yield good but that BPO

Dividend yield good but that BPO

Read on Twitter

Read on Twitter