China bank failure fires warning shot at financial markets

Liquidation of the municipal lender raises borrowing costs for small peers and push more of them on the brink

#Economy still wobbling, it’s a risky time to cleanse the system

#China #recession https://www.reuters.com/article/us-china-banks-baoshang-breakingviews-idUSKCN25608S?taid=5f30d21f6639040001f7259b&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

Liquidation of the municipal lender raises borrowing costs for small peers and push more of them on the brink

#Economy still wobbling, it’s a risky time to cleanse the system

#China #recession https://www.reuters.com/article/us-china-banks-baoshang-breakingviews-idUSKCN25608S?taid=5f30d21f6639040001f7259b&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

PBOC’s Attempt to Exit Crisis Mode Faces a $500 Billion Test

#China’s banks need $500 billion in fresh #liquidity this month to roll over existing #debt and buy government bonds, complicating the PBOC’s efforts to exit crisis measures.

#recession

https://www.bloomberg.com/news/articles/2020-08-04/pboc-s-attempt-to-exit-crisis-mode-faces-a-500-billion-test?sref=GCzETbXp

#China’s banks need $500 billion in fresh #liquidity this month to roll over existing #debt and buy government bonds, complicating the PBOC’s efforts to exit crisis measures.

#recession

https://www.bloomberg.com/news/articles/2020-08-04/pboc-s-attempt-to-exit-crisis-mode-faces-a-500-billion-test?sref=GCzETbXp

China’s central bank is buying government debt?

Clearing data suggest that central bank bought sovereign bonds. #PBOC hasn’t spelled out its intentions on government debt.

#China #recession #debt

https://www.bloomberg.com/news/articles/2020-08-12/china-s-bond-data-hint-central-bank-is-buying-government-debt?srnd=economics-vp&sref=GCzETbXp

Clearing data suggest that central bank bought sovereign bonds. #PBOC hasn’t spelled out its intentions on government debt.

#China #recession #debt

https://www.bloomberg.com/news/articles/2020-08-12/china-s-bond-data-hint-central-bank-is-buying-government-debt?srnd=economics-vp&sref=GCzETbXp

“A broad financial war has already started ... the most lethal tactics have yet to be used”

“We have to mentally prepare that the United States could expel China from the dollar settlement system”

#US #China #recession #economy https://www.reuters.com/article/us-usa-china-decoupling-analysis/in-china-fears-of-financial-iron-curtain-as-u-s-tensions-rise-idUSKCN2590NJ

“We have to mentally prepare that the United States could expel China from the dollar settlement system”

#US #China #recession #economy https://www.reuters.com/article/us-usa-china-decoupling-analysis/in-china-fears-of-financial-iron-curtain-as-u-s-tensions-rise-idUSKCN2590NJ

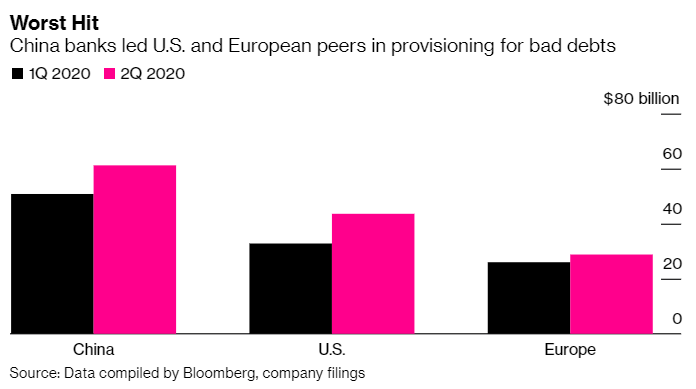

China's banking sector expected to dispose $490 billion of bad loans in 2020

“The sector will further step up bad loan disposals in 2021, as some of the problems will be exposed next year due to delayed loan payments”

#China #recession https://www.reuters.com/article/us-china-banks-loans/chinas-banking-sector-expected-to-dispose-490-billion-of-bad-loans-in-2020-xinhua-idUSKCN2590CV

“The sector will further step up bad loan disposals in 2021, as some of the problems will be exposed next year due to delayed loan payments”

#China #recession https://www.reuters.com/article/us-china-banks-loans/chinas-banking-sector-expected-to-dispose-490-billion-of-bad-loans-in-2020-xinhua-idUSKCN2590CV

“The world may once again be pushed to the verge of a global financial crisis”

China warns

China warns  Fed easing risks financial crisis + Bad debts at Chinese financial institutions balloons significantly.

Fed easing risks financial crisis + Bad debts at Chinese financial institutions balloons significantly.

#China #US #Fed #recession #banks #crisis https://www.bloomberg.com/news/articles/2020-08-16/china-s-banking-watchdog-warns-fed-easing-risks-financial-crisis?srnd=economics-vp&sref=GCzETbXp

China warns

China warns  Fed easing risks financial crisis + Bad debts at Chinese financial institutions balloons significantly.

Fed easing risks financial crisis + Bad debts at Chinese financial institutions balloons significantly.#China #US #Fed #recession #banks #crisis https://www.bloomberg.com/news/articles/2020-08-16/china-s-banking-watchdog-warns-fed-easing-risks-financial-crisis?srnd=economics-vp&sref=GCzETbXp

China joins in, central bank injects 700 billion yuan

So much for "PBOC’s attempt to exit crisis mode"

#China #recession #Economy https://www.reuters.com/article/us-china-economy-mlf-idUSKCN25D042?taid=5f3a14adcab0da00011cbac5&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

So much for "PBOC’s attempt to exit crisis mode"

#China #recession #Economy https://www.reuters.com/article/us-china-economy-mlf-idUSKCN25D042?taid=5f3a14adcab0da00011cbac5&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

Chinese citizens using cryptocurrency to move their money out of the country, hinting at capital flight

“Obviously, not all of this is capital flight, but we can think of $50 billion as the absolute ceiling for capital flight”

#China #recession https://www.cnbc.com/2020/08/21/china-users-move-50-billion-of-cryptocurrency-out-of-country-hinting-at-capital-flight.html

“Obviously, not all of this is capital flight, but we can think of $50 billion as the absolute ceiling for capital flight”

#China #recession https://www.cnbc.com/2020/08/21/china-users-move-50-billion-of-cryptocurrency-out-of-country-hinting-at-capital-flight.html

Unlicensed asset management companies are still operating in China, causing a “serious threat to financial stability”, a top official of China’s central bank.

#China #economy #recession https://www.cnbc.com/2020/08/22/chinas-unlicensed-asset-management-firms-still-a-threat-central-bank-official-says.html

#China #economy #recession https://www.cnbc.com/2020/08/22/chinas-unlicensed-asset-management-firms-still-a-threat-central-bank-official-says.html

China brace for record defaults as delinquencies are accelerating. Dangerous new phase for the nation’s $4.1 trillion corporate bond market.

China brace for record defaults as delinquencies are accelerating. Dangerous new phase for the nation’s $4.1 trillion corporate bond market. “Government has neither the firepower nor the will to backstop it all”

#China #debt #bonds #recession

https://www.bloomberg.com/news/articles/2020-08-23/china-investors-brace-for-record-defaults-in-risky-end-to-2020?srnd=economics-vp&sref=GCzETbXp

China

"Current economic situation is complex and severe”

People’s Bank of China Governor Yi Gang urged banks to support smaller companies through innovations in financial services and products.

#China #PBOC #recession

https://www.bloomberg.com/news/articles/2020-08-23/pboc-s-yi-urges-china-banks-to-support-smaller-companies?sref=GCzETbXp

"Current economic situation is complex and severe”

People’s Bank of China Governor Yi Gang urged banks to support smaller companies through innovations in financial services and products.

#China #PBOC #recession

https://www.bloomberg.com/news/articles/2020-08-23/pboc-s-yi-urges-china-banks-to-support-smaller-companies?sref=GCzETbXp

Beijing has enlisted nation’s mega banks to aid in recovery and they are ramping up their recruitment joining other state-owned firms in boosting employment even as lenders deal with plunging earnings and ballooning bad debt

Beijing has enlisted nation’s mega banks to aid in recovery and they are ramping up their recruitment joining other state-owned firms in boosting employment even as lenders deal with plunging earnings and ballooning bad debt#China #recession #Banking https://www.bloomberg.com/news/articles/2020-08-24/china-s-banks-hire-tens-of-thousands-in-latest-rescue-mission?srnd=premium-asia&sref=GCzETbXp

China's Xi worried?

China's Xi worried?Warns "period of turbulent change" as external risks rise

Economy is facing a period of turbulent change and rising external markets risk required policymakers to increasingly rely on domestic demand to spur growth

#China #recession https://uk.reuters.com/article/us-china-economy-xi/chinas-xi-warns-period-of-turbulent-change-as-external-risks-rise-idUKKBN25K1B7

China’s 4 biggest banks face $940 billion capital shortage by 2024... to meet global capital requirements designed to protect the public and the financial system against massive bank failures

China’s 4 biggest banks face $940 billion capital shortage by 2024... to meet global capital requirements designed to protect the public and the financial system against massive bank failures#China #recession https://www.bloomberg.com/news/articles/2020-08-26/china-s-biggest-banks-face-940-billion-capital-shortage-by-2024?utm_content=business&utm_medium=social&cmpid=socialflow-twitter-business&utm_campaign=socialflow-organic&utm_source=twitter&__twitter_impression=true&sref=GCzETbXp

China central bank injects $29 billion via reverse repos

China central bank injects $29 billion via reverse repos... injected 200 billion yuan into the banking system, a batch of 150 billion worth of reverse repos is set to mature, leaving 50 billion on a net basis via the #liquidity tool

#China #recession https://www.reuters.com/article/us-china-openmarket-repo-idUSKBN25M03Y?taid=5f45de4deeb1e90001e57dce&utm_campaign=trueAnthem%3A+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

Big four #China banks see a surge in loan losses, been told to forgo profits to support the #economy

Big four #China banks see a surge in loan losses, been told to forgo profits to support the #economy“Profitability in the banking sector will continue to face relatively large pressure in the coming one to two quarters as risks may further increase”

https://www.bloomberg.com/news/articles/2020-08-30/bad-debt-wave-drags-china-s-big-banks-to-their-worst-profit-drop?sref=GCzETbXp

Warning signs are flashing for China’s $45 trillion banking industry

Warning signs are flashing for China’s $45 trillion banking industryProfits are plunging at the fastest pace in at least a decade, bad debt has hit a record and capital buffers are eroding.

#China #recession #debt #banks

https://www.bloomberg.com/news/articles/2020-09-02/beijing-pushes-its-big-banks-to-weakest-health-in-a-decade?cmpid=socialflow-twitter-business&utm_content=business&utm_medium=social&utm_source=twitter&utm_campaign=socialflow-organic&sref=GCzETbXp

Read on Twitter

Read on Twitter